November is the month where guest behavior becomes more predictable, calendars tighten, and every adjustment in pricing or amenities can swing the next eight weeks of returns.

The U.S. Short-Term Rental Market: Strong Holiday Pricing, Faster Booking Cycles

The national STR market is entering the holiday period with renewed strength. According to Key Data, the U.S. vacation rental sector is experiencing some of the strongest pricing momentum of the year, and operators who stay agile—especially with late-booking behavior—are best positioned to capture the gains.

Important to note: Holiday revenue strength is being driven by higher prices—not longer stays or earlier bookings. Guests are willing to pay a premium for peak dates, but they’re not booking far in advance.

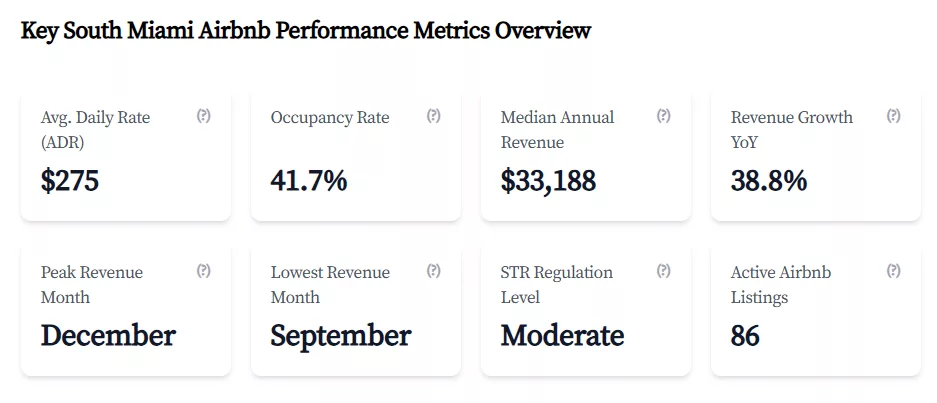

Miami: Pricing Power Returns as High Season Approaches

Miami’s market continues to follow its sharply seasonal rhythm—one that rewards strategic pricing more than any other variable.

October–November remains the shoulder-season recovery period:

- Occupancy gradually improves

- ADR stabilizes

- Forward pacing shows RevPAR likely outperforming 2024

Lake Tahoe: Big Shifts in STR Regulations Heading Into Winter

Lake Tahoe’s short-term rental landscape is undergoing one of its most significant regulatory shifts in years. Because Tahoe is split across multiple jurisdictions, each region has its own rules, caps, and processes. As of November–December 2025, here’s the updated regulatory map:

- City of South Lake Tahoe (CA): STRs allowed citywide under a new 2025 ordinance; 150-ft anti-clustering buffer outside the Tourist Core; no total cap (but permits roll out in batches); occupancy is stricter outside the Core.

- El Dorado County – Unincorporated Tahoe Basin (CA): Cap = 900 permits in the Basin + 500-ft buffer from any active VHR; county map shows active/pending locations.

- Douglas County – Tahoe Township (NV: Stateline, Zephyr Cove, Glenbrook, Cave Rock, etc.): Cap = 600 permits + neighborhood density limits; new permits only in unconstrained areas, waitlist for full areas.

- Washoe County – Incline Village/Crystal Bay (NV): STRs permitted in unincorporated Washoe County only (not Reno/Sparks); no countywide cap posted; permit required.

- Placer County – North & West Shore (CA: Tahoe City, Kings Beach, Tahoe Vista, Homewood, Tahoma, Olympic Valley, Northstar): Cap = 3,900; once cap is reached a 30-night minimum kicks in (owner-occupied exempt); multiple STRs per parcel allowed under certain conditions.

- Town of Truckee (CA): Cap = 1,255 certificates; waitlist currently in effect; 365-day wait after a sale before a new owner can even apply; ADUs and multi-family phased out for new registrations.

How Lunabase Leverages Holiday Demand

As November’s demand accelerates—late bookings, shorter stays, rising December ADR—this is the moment when professional management matters most. Here is how we turn those patterns into predictable results:

We price ahead of the curve, not after it

We adjust rates in real time based on pacing trends, ensuring your property captures the premium value in the $424 December ADR—not after the peak passes.

We optimize listings to win late-booking guests

Shorter stays (now down 9% YoY) mean guests compare more aggressively.

We restructure photos, titles, and amenity highlights so your property converts quickly in compressed search windows.

We enhance guest experience to lift ADR, not expenses

Holiday travelers spend more per night but expect more convenience.

Our targeted upsells—early check-in, grocery setups, ski-ready amenities—create incremental revenue that often lifts total RevPAR 8–15%.

Events in Miami

Miami Bookfair Guide (Nov 16-23)

- Downtown Miami

Events in Lake Tahoe

Palisades Tahoe Opening Day (Nov 26)

- Palisades Tahoe

Stay updated

Follow Lunabase Management on Instagram for expert advice, tips, and the latest updates on the STR market!